Table of Content

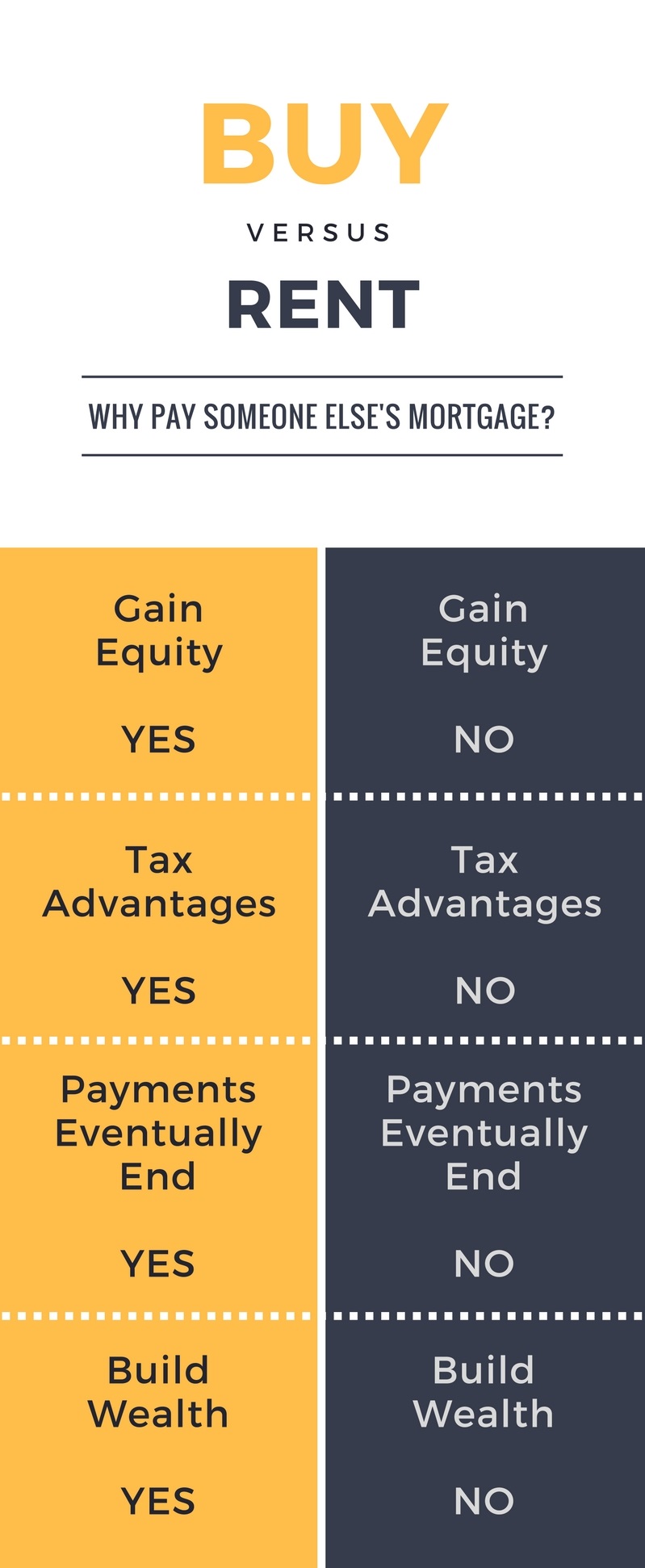

Set your assumption at 5% down payment instead of 20%, and the tool will automatically calculate the opportunity cost of the money and the change in mortgage payments. When you rent vs. buy, you get a roof over your head but the payments go toward building your landlord’s equity. In affordable housing markets, it can be less expensive to buy than rent in the long term. But in costlier markets like New York City or San Francisco, many residents rent by default because home prices are simply out of reach.

Closing costs for the buyer include lender fees, appraisals, inspections, and other costs. We estimated it as a percentage of the home purchase price. Mortgage Interest Rate—Considering the size of a home purchase, one can expect the amount of money going towards interest to be relatively high, even in an environment of low mortgage rates. Borrowers can calculate this cost simply by inputting the interest rate listed on the mortgage papers from the lenders to run calculations. Home Appreciation Rate—For most people, purchasing a home is the largest investment they'll ever make. Not surprisingly, the higher the estimated appreciation, the more sense it makes to buy.

How Long You Have to Live in America’s Biggest Cities for Buying to Make Sense

In particular, the assumptions that you make for annual investment return and annual home value appreciation will cause the answers to swing quite a bit. With that in mind, I’d suggest trying out a range of assumptions in the model before making your mind up. This model only accounts for the financial aspects of your decision. There are many non-financial factors that might influence the decision to rent or buy your home. More often than not, there are significant ‘lifestyle’ differences between renting and buying that are not taken into account if we just look at the numbers.

If your future is less clear, however, you may have more to consider. We take the initial rent amount you entered and then use the inflation rate, which you can also adjust, to calculate rental payments in the future. You can also add rental insurance or other expenses at your discretion. We use your marital status to determine the amount of taxes you will pay both while renting and owning. As there can be tax benefits to owning this helps us provide a more accurate answer.

Social Security & Medicare

The Residential Tenancies Act of each province also specifies the maximum percentage rent increase that your landlord is allowed to increase your rent by each year. This ensures that you will not end up paying unreasonable amounts on your rental agreement. It does not cover damages due to wear and tear or typical usage for your home. On average, Canadians pay between $500-$1000 per year for homeowners insurance. Homeowners are actively building equity in an asset, and payments are working toward that equity.

In addition to the interest rate and down payment, the calculator takes into account the mortgage-interest tax deduction. As it stands, you can model in these types of impacts in the assumption field for “other monthly payments” in either the rent scenario or the buy scenario. This can be used as a catch-all for anything that hasn’t already been considered. In the US, there is PMI and a couple of other insurance programs. Test out a range of assumptions before making your decision. The answers that you’ll get from this model will change significantly even with small changes to certain assumptions.

Member Benefits

Again rentals have appreciated at 10-25% in the past which is not true over long term. In the long term, rentals have a tendency to follow the inflation pattern. Monthly Rent – Fill out the monthly rent of a similar property that you are planning to purchase. Downpayment – Enter the cash component that you would put in the property from your personal savings. In case, you are not planning to take a loan you can put Property Price here. The first thing to consider when choosing between renting and buying a home is where you are financially.

For closing costs, which will run you about 3% to 5% of the loan amount. The tax implications of buying and selling a home will depend on your federal tax filing status. Impacts costs such as maintenance and renovation costs, which we assume increase at the rate of inflation.

Connect with a lender

Forced Savings – When you decide to buy a home, first you force yourself to save for the high downpayment and then you indirectly save when you pay off the home loan. Making Improvements – When you own a house, you can fix up your bathrooms the way you want, build a modular kitchen and paint your walls orange or yellow if you like. While if you stay in a rented house, you have to comply by all conditions imposed by landlord. In case, the chart shows negative savings for all 30 years of analysis, then that means Renting is always better for your particular situation. Positive Savings throughout means that Buying is always better.

If you do not buy now, same property may go out of your budget later. If you’re interested in purchasing a home with an HOA/Condo fee, enter that monthly cost here. Just remember, the more you put down, the less your payment will be.

Unfortunately, these are some of the hardest things to predict. If you choose to rent instead of buying, the calculator assumes that you’ll spend your would-be down payment on stocks or another investment. For example, in the buying scenario you could add a monthly payment of $150 per month in extra transportation costs. This would make the renting scenario look better in comparison. An adjustable-rate mortgage or ARM has an interest rate that can change.

In general, you’ll need to live in a home for about 5 years to recoup all the closing costs. And it takes more to sell and pack up a house than to leave an apartment behind. So spend some time thinking about your career and family plans.

The following is the average cost based on the length you stay for the next 30 years. It protects you from damage to your home or possessions. Homeowners insurance also provides liability insurance against claims by people who might be injured due to accidents in your home or on the property. Home equity Talk to a lender to see how much you can access. Also check other intangible factors given below, that affect your decision of Renting or Buying a home. Simply fill in all the fields below, using your best estimate when unsure.

In today’s economy many people move to different cities every 2-3 years to explore better job prospects. If your time horizon is short term and if you are unsure of the city you want to settle in, renting is a better option. Stability – While renting, you are always bothered about rental increases or when your landlord may decide to sell the house. If you stay in your own house, you don’t have to worry about such issues. This Rent vs Buy Calculator is a comprehensive excel based calculator that can help you in resolving your dilemma of renting vs buying a home in India. This calculator takes into account all major factors and is always updated so that you get the most accurate results.

The counties identified below are the places where buying makes more financial sense than renting in the shortest period of time. Both have seen their populations fall in absolute terms in the past 50 years (Philly’s by 25% and Detroit’s by 50%). The result is a housing supply far larger than demand, and, in turn, bargain basement prices. On average, a resident of either of these cities should only stay in a rental if she might be moving in the next 3 years.

Renters who want to decrease living expenses can do so easily by selecting a less-expensive housing arrangement. Homeowners must go through a more involved process, which includes putting their home on the market, waiting for the right buyer and then finding a new home to purchase. Renting doesn’t require you to tie up a large sum of money in a housing investment. The amount of home maintenance you can expect to pay will vary greatly with the age and condition of the home.

No comments:

Post a Comment