Table of Content

Loan Amount – The calculator automatically calculates the loan amount by subtracting Downpayment amount from the Property Price. Property Price – Enter current price of property that you want to purchase. Hence, this rent vs buy calculator is designed to tell you exactly for how many years you must stay in the house to justify your Buying decision. Capital Appreciation – India is a developing economy and over long-term prices will keep going up as the income levels go up.

For a more precise estimate, divide your home cost by 1,000 and multiply by $3.50. There’s no right answer when it comes to renting versus buying. Your financial situation and future plans can help you figure out if buying or renting is right for you. Sure, you need to keep your apartment or rental home in good condition, but chances are when the lawn needs mowing, someone else mows it.

Social Security & Medicare

If you expect that trend to continue in the area you are looking to buy a home, then enter an annual rate here. This is the number of years you would expect to stay in the home before selling it. This number is used as the time variable for the rent vs. buy decision. If you rent a home, then the structure is usually insured by the owner of the home or building. Your personal property, which is contained within the structure, is covered by renters insurance.

Perhaps the most important factor to consider when making this buy or rent decision is how long you plan to stay in your home. If you’ll only be in town a year, renting will almost always be your best choice. The calculator keeps a running tally of the most common expenses of owning and renting.

Buying a Home

Unless you have a zero-down mortgage, you’ll need anywhere from 3 percent to 20 percent for a down payment, as well as additional funds to pay closing costs. These amounts can vary depending on your loan type and purchase price. If you buy a home and decide soon after to move, you could lose money on your purchase if you haven’t stayed long enough to recoup the initial costs. And, depending on market conditions, your home may not sell quickly or for as much as you paid for it.

Refinance calculator Decide if mortgage refinancing is right for you. The rate at which your rent is likely to increase each year. The rate at which you expect the home value to grow after buying. Use our simple rent vs buy calculator to find out which option is best for you.

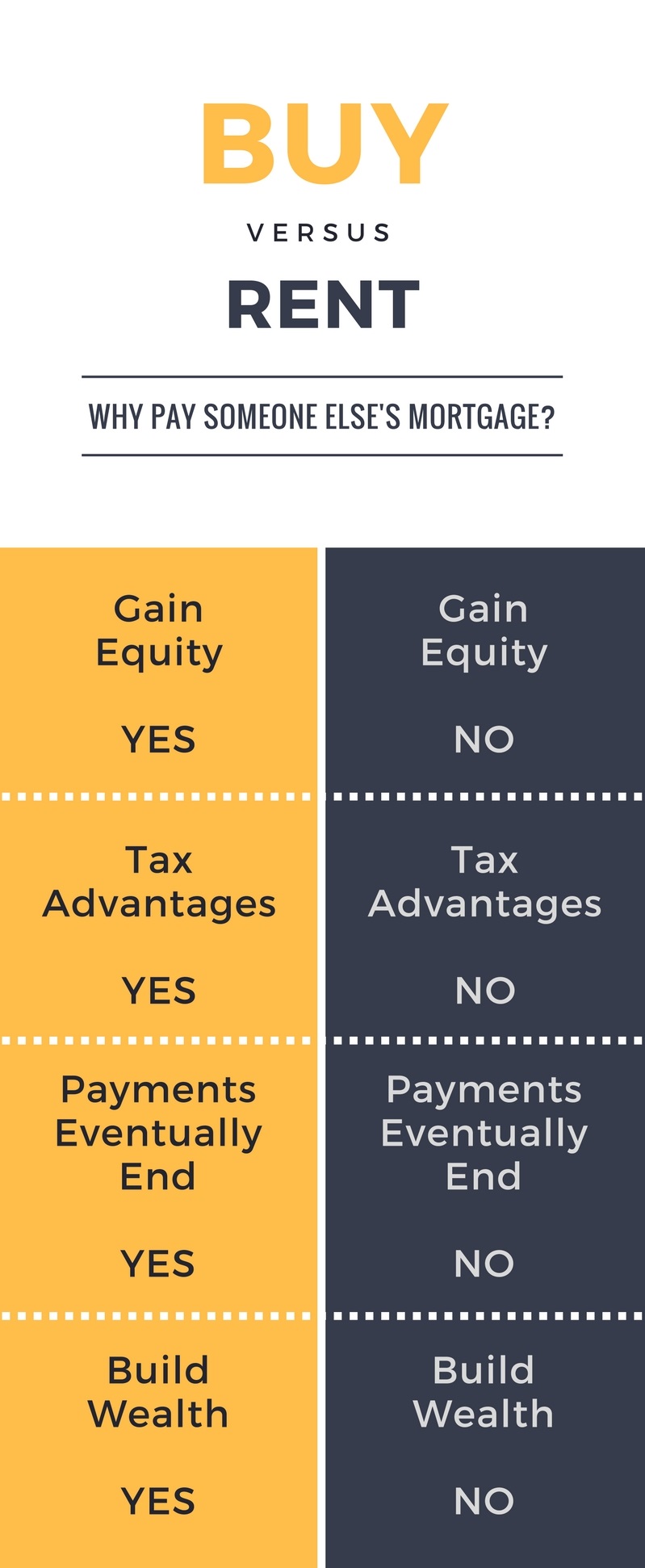

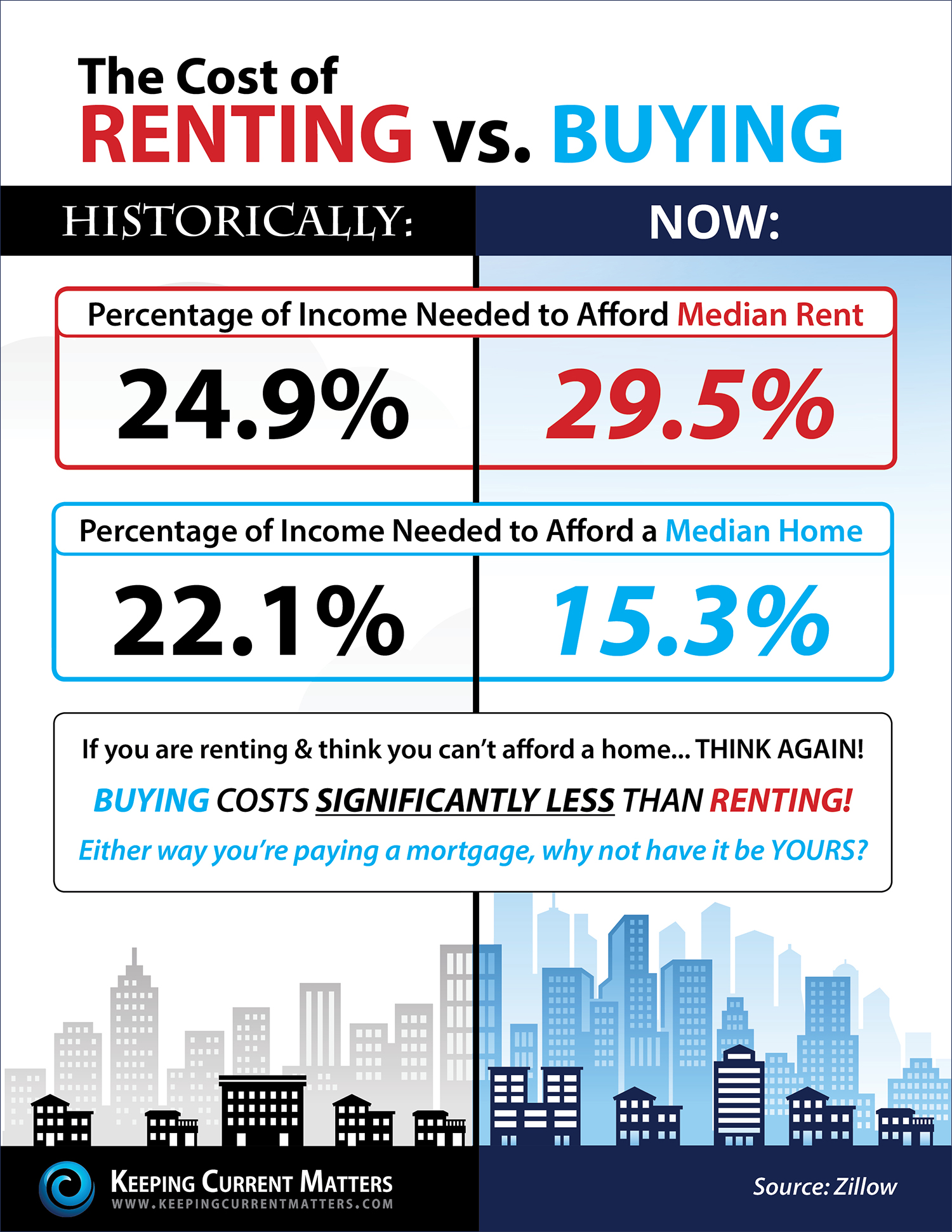

Renting vs. Buying

In addition to maintaining your home (think mowing the lawn, cleaning gutters, winterizing the pipes, etc.), you also foot bills for maintenance, upgrades and repairs. If you don’t have extra cushion in your budget for these items, or if you don’t want the burden of keeping up a home, renting may be the better fit. However, if you’re game for putting in some sweat equity and you have room in your budget to save for unexpected repairs, homeownership may be up your alley. Having flexibility is one of the top considerations to make when you’re deciding whether to rent vs. buy.

Just as the apartment, condo or home you rent is another person or company’s investment, they also get most of the tax benefits and deductions. You may be eligible for a few deductions, even if you rent; ask a tax advisor to see what’s available. The Land Transfer Tax is a tax levied by the provincial government payable at the time of closing. The Land Transfer Tax Rebate is a rebate on the Land Transfer Tax that the provincial government offers to first time home buyers. This rebate can either be for the full or a partial amount of the tax, depending on the province. This is the calculated down payment you would have made on the home based on the price paid and mortgage amount.

Therefore, it makes sense for those with an uncertain future to rent instead of buy. Expected Annual Salary Hike – Enter expected average annual rise in your salary in percentage over long term. Housing Overpriced – Like stock markets, Real Estate has a tendency to create bubbles.

In 1973 the average new home was 1,660 square feet and the median new house was 1,525 square feet. By 2015 the average new house was 2,687 square feet and the median new house was 2,467 square feet. Both average and median home sizes were up 62% and that was before the COVID-19 crisis accelerated the work from home movement. You could be one of the unlucky ones whose property nosedives in value, but on average, you can expect your home to increase in value over time.

For closing costs, which will run you about 3% to 5% of the loan amount. The tax implications of buying and selling a home will depend on your federal tax filing status. Impacts costs such as maintenance and renovation costs, which we assume increase at the rate of inflation.

This calculator allows you to compare renting versus buying by entering how much you want to spend a month and how much down you would put into your house. On the other hand, homebuyers have to undergo a more rigorous process when they apply for a mortgage. It involves substantial paperwork, and borrowers have to submit numerous documents to verify their credit, income, assets, liabilities, employment and finances. If they get any help from a friend or relative for a down payment, they have to provide a gift letter and additional documentation showing how and when the money changed hands. A security deposit is the amount of money you give to your landlord at the beginning of a lease. This deposit is usually equal to one month's rent and covers any damage the tenant causes to the property.

Renting affords you the freedom to move each year with no strings attached. You also gain equity when the market value of your home goes up. Try a rent vs. buy calculator to see which is right for you.

The Rocket Mortgage Learning Center is dedicated to bringing you articles on home buying, loan types, mortgage basics and refinancing. We also offer calculators to determine home affordability, home equity, monthly mortgage payments and the benefit of refinancing. No matter where you are in the home buying and financing process, Rocket Mortgage has the articles and resources you can rely on. The total cost before selling / moving is the total monthly expense multiplied by the number of months you expect to live in the home. The value for renting has been adjusted for the expected annual rent increase. This is broken down by mortgage payments , mortgage loan insurance, property tax, maintenance, utilities, insurance, condo fees, and other expenses.